We are pleased to announce the winners of the Bristol Social Impact Awards 2024! The awards ceremony took place on the evening on February 29th 2024 at South Bristol Skills Academy in Hengrove.

Below are the winners for each category:

The Bristol Social Impact Awards are back tonight (29th Feb 2024), where we will be celebrating the people that strive to make Bristol a great place to live, work and volunteer.

We received just under 300 nominations from...

Over the last few months we have been asking you, the public, to nominate the individuals, groups and organisations who you think are making amazing contributions to building community in Bristol and deserve some wider recognition. We were delighted to receive over 270 nominations!

...

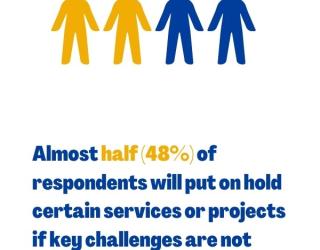

In March 2023, we launched our inaugural Pulse survey, and between July and October we completed our second iteration of the survey. Your responses were compared with what we found previously, as well as wider findings gathered on a National level.

One of the concerning results...

Bristol Women's Commission has written a letter to local media announcing 16 days of activism against gender-based violence, from November 25th until December 10th. The letter - to which Voscur CEO Rebecca Mear is a signatory - reads:...

Does your organisation work to improve health and wellbeing for people in Bristol, North Somerset and South Gloucestershire (BNSSG)?

Whether you’re working in the voluntary, community or social enterprise (VCSE) sector, the local authority or if you’re a part of the Integrated Care System...

Nominations are now open for the Bristol Social Impact Awards (formerly The Voscurs), with a deadline for nominations of January 21st 2024 (11:59pm)

This prestigious awards ceremony will return on Thursday February 29th, and now is your chance to show your appreciation for a local third...

This year, our Have Your Say Forum event will be immediately followed by our AGM, in a double-event extravaganza!

These events will take place on December 5th, at The Park Centre. We are offering the opportunity to reserve your place at one or both events, via the links below:

To...

Locality is the national network of community orgs. They have over 1,600 members who help hundreds of thousands of people every week. Offering specialist advice, peer learning and campaign with members for a fairer society.

On 7-8th November Locality are hosting their annual...

After thirteen years at Voscur, Mark Hubbard (Development Director) has decided to take on a new challenge. Everyone at Voscur is grateful for Mark's work, and he has shared some reflections on his time in post: "I am inspired and fed by the amazing, creative, dedicated transformative work...